What is Freehold?

Colin Dismuke / October 10, 2020

15 min read

This is a transcript of Patrick Stanley's overview of Freehold. It has been lightly edited and condensed.

It was created using Descript's excellent transcription service and listening to the audio at 0.5x to fix any errors.

Patrick Stanley: I'm Patrick Stanley, the founder of Freehold. You can follow me on Twitter @patrickwstanley.

So, proof of hodl communities is the big concept behind Freehold. The question is, is hodling an under explored use case for cryptocurrencies?

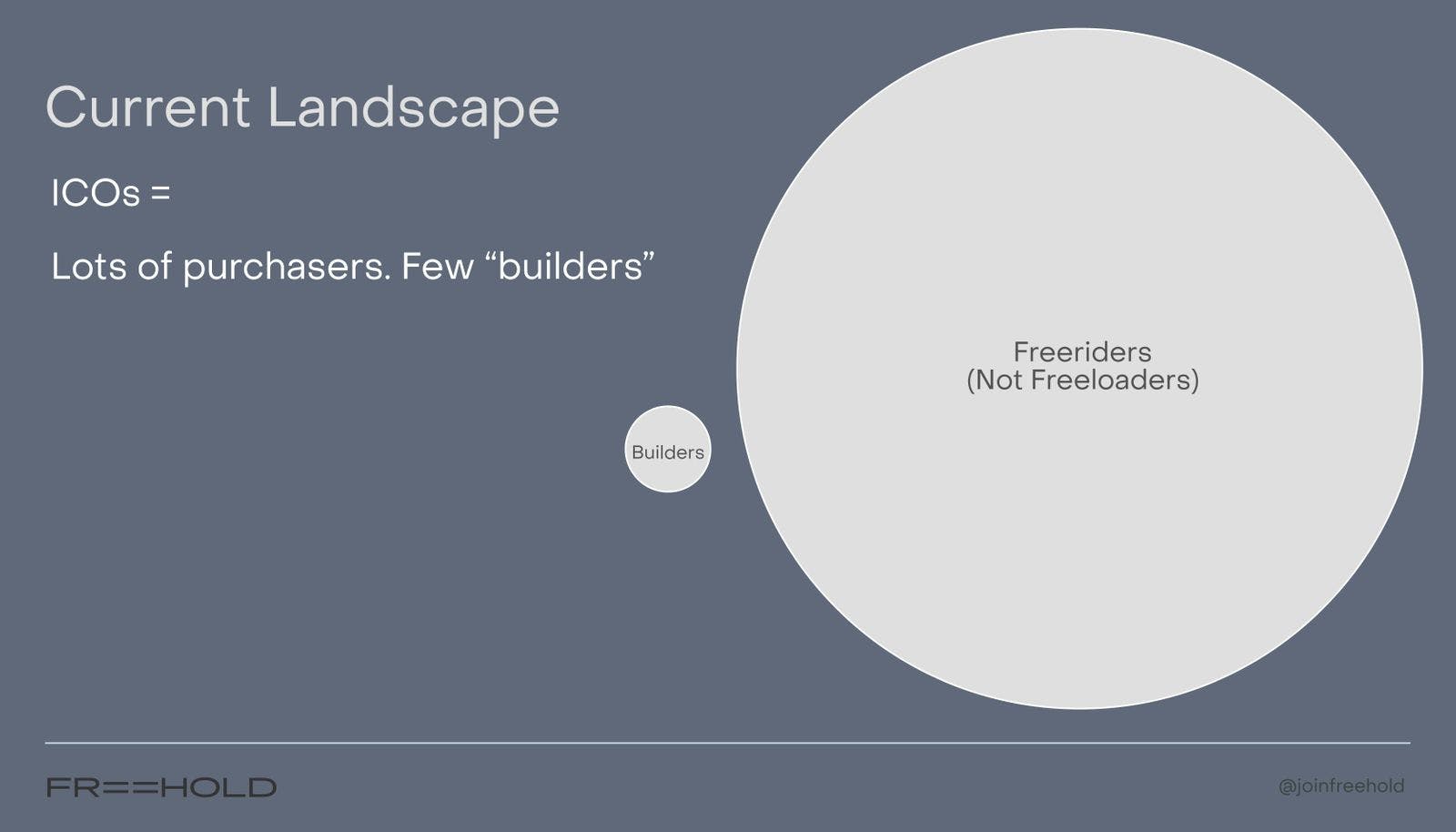

Current Landscape

Let's take a look at the current landscape to get a better picture. The current landscape is when folks start crypto projects, typically they do a large ICO. They're raising millions or tens of millions, sometimes even billions of dollars and they're creating a lot of people who are holding the token but not necessarily doing specific actions to further the mission and values of that token. You end up with a lot of freeriders who purchased and don't do much beyond that. Maybe trading, maybe hodling, not to be confused with freeloaders who would be like a couch surfer, and very few builders. I would've made that builder's circle a little smaller if it were a legible, the number of builders building on most of these projects is minuscule compared to the number of investors. That's the first snapshot of the current landscape.

Current landscape point number two: token volatility makes tokens an unnatural unit of exchange. Some tokens go up and down 30% in a given day. This makes them not useful as a unit of exchange. A lot of applications, especially in 2017 would say, okay, buy our token so you can use it like it's a currency in app. That's a very hamfisted way of trying to get people to use your cryptocurrency. The reality is that they’re not going to use it for that reason. People really only have enough cognitive overhead to make sense of one or two currencies. If you're living in the United States you're using USD every single day.

This chart, with the Y axis removed, is Bitcoin cash's volatility. I find that funny because a lot of the Bitcoin cash folks wanted it to be treated as cash – they're still suffering from volatility. The last point I'll make on this is: people are not spending cryptocurrency like it's money; they're holding on to it. Most of it is speculation; we're still in the cryptocurrency casino.

Point number three about the current landscape: the biggest winners, customer-wise are exchanges. Coinbase has over 35 million users who are buying and selling cryptocurrencies and not really doing much else other than that. You might get some staking but that's a very recursive sort of behavior where you're essentially running in place to escape inflation. That's very low grade “work” being done on behalf of a protocol.

Proof of hodl login

What if we were to acknowledge all these things and try to change the current landscape by leaning into hodling and bringing more utility to it. Enter proof of hodl login. The concept is: accessing applications or communities or experiences based on your holdings. Imagine you have a hundred dollars of Bitcoin and there's a suite of applications that allow you to access them only once you've had a hundred dollars of Bitcoin. That concept is generalizable to any token.

The way to enter in to an application experience is you'd either earn the currency, so you can become a part of the in group, or you'd purchase it, or you’d mine it. I think that mining is a pretty interesting one, consult your attorneys by the way, if one were to launch generalized mining where anyone can mine. I think that, in my opinion, would move the token further away from security status. Not to say it wouldn't be considered a security, but I think we're getting a little bit further away from that territory which is great for innovation and community growth.

Number two, it grows a new class of users called user-stakers. This is a fundamental breakthrough in business model generation. We'll discuss this in a bit, but it essentially collapses the notion of a stakeholder and a user. They are one in the same in this new model. Given a proof of hodl login function, you wouldn't necessarily want to hold tokens that are clearly marked for access control unless you we're satisfied with what's on the other side of that.

So you're not only a user, but you're a staker.

Number three, you're going to have a very low minimum balance. Or you can have a very high minimum balance. You can have $0.10 or $1 or $10 in crypto to get in. Or a $1,000,000 or $10,000. So as a community builder or founder you can modulate that to make it work for your application.

And the last thing, importantly, is no transaction fee is needed. You just sign in with your keys. There's no transactional blockchain, no blockchain bloat. You're being economical with your usage of the blockchain.

So proof of hodl login and user staking, specifically, as Joel Monegro, friend of the project, has stated it creates a kind of opt-in economic lock-in that benefits the user by turning them into stakeholders in the success of the service. How I interpret that section, from his thin protocols blog post, is that early users can also be treated as early employees, early founders, or early stakeholders, and they can not only use the app, but also do work for the app to grow the app. You could reward this collective or individual effort, this is what Freehold is doing, you could reward the effort for things like referrals to new Hodlers.

Imagine having a box score of new converts who are hodlers and giving an individual or a collective rewards for reaching certain milestones. That's an objective measure that you can measure pretty well and that is fairly hard to game.

Second thing is you can build more software for hodlers. Friedger, one of the members of the Blockstack Stacks ecosystem created an app called Speed Spend.

He has a proof of hodl function on it that he's demoing that requires you, and this is a demo, but essentially what you can do is you can flip a coin and bet against someone else who has also hodled a certain amount. It's nice because it puts a little bit of a governor on degenerate gambling by requiring you to have some funds up front.

The other thing you can reward is collective goals that are hit. In the case of Stacks, it may be the case that once we have over a hundred thousand dollars of Bitcoin going through and going through the proof of transfer mining function. Let's say like a 10 day trailing average of daily, a hundred thousand dollars of Bitcoin going through, that's worth celebrating, that's worth rewarding. The community may have had a large part in evangelizing that new security model and the people's willingness to participate in the mining.

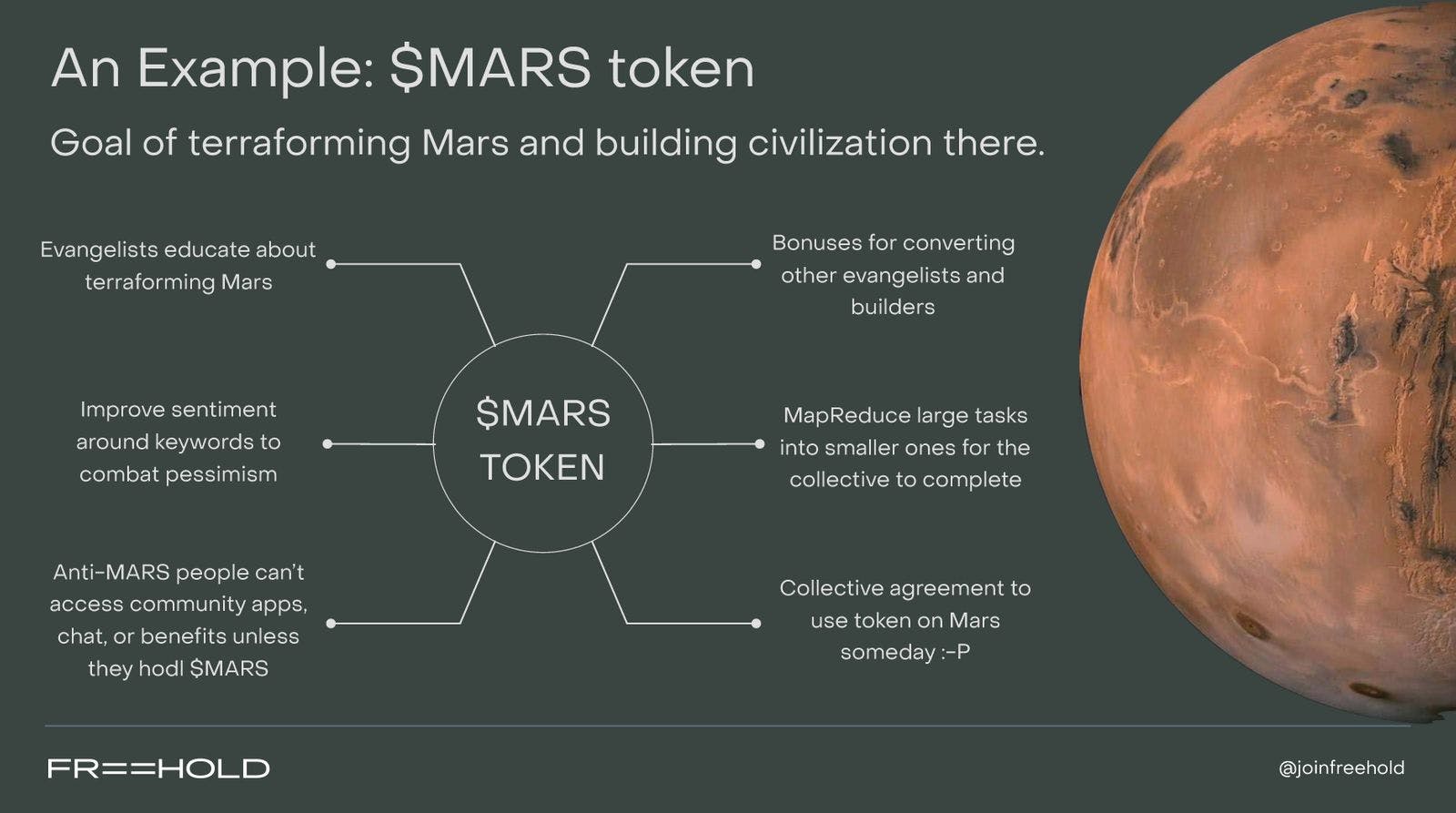

$MARS

There's a bunch of other examples as well. Let's take a whimsical example: let's say we create a Mars token $MARS and the goal of the token is to terraform Mars and begin building a civilization there. With the Mars token you can pay evangelists for educating about terraforming Mars and improving sentiment around keywords to combat pessimism, because obviously there'll be some anti-Mars people that don't want to terraform and they may be adversarial to the notion. Those anti-Mars people presumably wouldn't buy the tokens because that would be to the benefit of the pro-Mars terraforming people.

So, if you're not hodling $MARS token then you can't get into that community, you can't be rewarded, you can't get the benefits. $MARS tokens can convert fellow Martians by giving them bonuses for converting. Community leaders in the ecosystem who have mined a lot of $MARS token and want to further advance the idea might put large tasks or challenges up that can be MapReduced or parallelized. Parallel tasks that lead up to a larger goal being completed and rewarding them. DARPA did this with the red balloon challenge. If you want to Google that, that's a good example there. Lastly, the folks who are bought in and have skin in the game and are economically aligned in addition to values aligned, might just collectively agree to use that token on Mars someday. That's a tongue in cheek example but I think that kind of gets the point across.

Other Proof of Hodl Communities

There's tons of other proof of hodl communities. I was just talking to a Stacks community member and friend named Jason who is thinking about creating a newsletter that's proof of hodl. Great idea to do that with a super simple business model. If people want to have access to your newsletter then they should hold a certain amount of your token.

I can imagine someone creating a chat room where you have to have a token to get in and then, boom, you're in a group of people who have the same values as you and have skin in the game. They're not just virtue signaling, they're also value signaling and they can do this with pseudonyms or real names.

A third category is regular services and apps. They might provide a discount if you have a really good referral mechanism in place. I keep using this example because I think it's very applicable, it might be in your best interest to actually try to convert more token holders as opposed to having them pay you in fiat because you can actually geometrically expand the value of the ecosystem through leveraging those new converts, those new hodlers.

For the example of gambling, we gave that example already.

Fifth example is something I find very interesting and I'm still trying to figure out how to brand this but effectively there are affinity groups and you can have $VEGAN or $CARNIVORE. That $MARS example earlier I mentioned earlier, really, what this is is values-constrained tokens. One of the outstanding problems to solve in that model of values-constrained tokens is attribution. How do you attribute that someone has furthered the vegan movement, et cetera. It's not an unsolvable problem though, I think we can work on it and hack it.

And then lastly, other open protocols, new and old alike, of tight knit hodlers can use this model to coordinate labor, communications, et cetera. I think the reality is when you look at say Bitcoin maximalists and even at Ethereum maximalists, those folks don't have that much Bitcoin and ether. They’re mostly virtue signaling and they're playing a status game, not a value game.

What this does, this forces people to put their money where their mouth is and play a value creation game as opposed to a status game. Folks using this model to earn and learn is highly potent. And I think generally, if the 2010s we're defined by engineers as founders and salespeople as founders, like Zuckerberg and Sergey Brin as engineers as founders and Mark Benioff and Steve jobs as sales folks. I think this next generation, this next decade is going to be marked by community builder as founder. What I'm trying to do is I'm trying to validate within the crypto space first, the existing open protocol space first, and eventually expanding outwards toward other community groups, this new business model of user staking so that more community builders can create valuable experiences and products with their community.

So I think this is fundamental and I think we're at the early part of a massive wave of community builders as founders.

Cool, so I alluded to this: is there a smarter way to grow a community and fundraising? I would say it's to be determined, we'll see. Certainly, leveraging a community from the outset could be more beneficial than just doing a fundraise or having to worry about SEC compliance and things like that. I think there are ways to very neatly start new movements with a group of people where there's no primary issuer of the token. It's almost like a natural resource that everyone gravitates around.

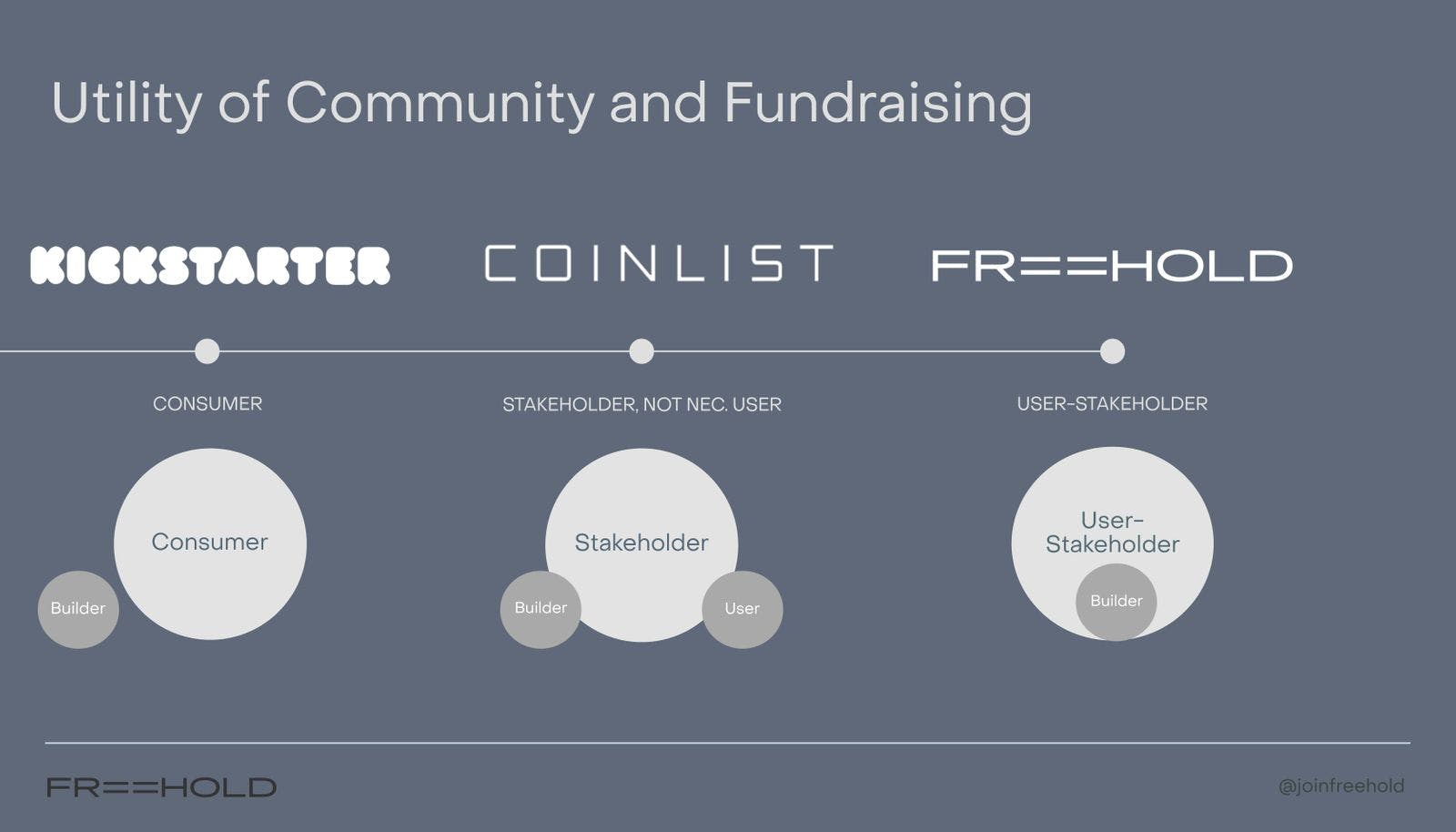

Utility of Community and Fundraising

To give a good comparison of the utility of community and fundraising: on the way left, you have Kickstarter where you have consumers who have conceptual product market fit. You're buying something for which there's conceptual product market fit, where the builder has all of the onus of making it happen and then just delivering it to the consumer. After that, maybe they stay on their email list, but really the relationship is largely over.

Coinlist is in the middle of the spectrum where they're doing sales to large stakeholders but many of the stakeholders are not actually builders as I alluded to in one of the first slides. Many of them are not even users and I'm not counting staking as usage. I’m counting using applications on a daily or weekly basis, or being pseudo employed by or contracted by the token. On the far right is the Freehold model, this is a user stakeholder model. The user, stakeholder, and the builder are all one in the same. You can be a user and stakeholder and not a builder, but I think a lot of people will choose to be builders. I think a lot of community-builder-founders will choose to carve out that small section of people that hold a stake, and want to do work, and focus on growing that group. By focusing on growing that highly potent subset of stakeholders, what you're doing is you're creating a very robust movement of folks that are both pro-growth and pro-wealth.

For Future Consideration

One of the last things is for future consideration, making this concept live beyond our own lifetimes is the idea of pushing an application via smart contract that is a permanent freehold with proof of hodl access. It could be a simple chat room or just an app experience, but it would be a place for those folks who are economically and values aligned alone to occupy it. At the top of the slide, the old definition of a freehold is simply a permanent and absolute tenure of land or property with the freedom to dispose of it will. What that means is, folks in the physical world, but also in this new model, have the option to liquidate an exit whenever they want. That's a huge, huge benefit. You're not just voicing your frustration or your appreciation, you're choosing to vote with your feet and your dollars and this kind of expression to summarize that concept is capital flight at the speed of light.

Imagine thousands of freeholds competing over your attention and your willingness to have a symbiotic relationship with it as a user staker. I think that's a really great model and it recognizes the value of each human being and what they bring to the space and also recognizes the values of each individual.

And I think what it could potentially do is actually expand the amount of wealth that exists in the world. I don't think this is a zero-sum thing. I think this can be very positive-sum and I'm super excited to pull this into reality with everyone here.

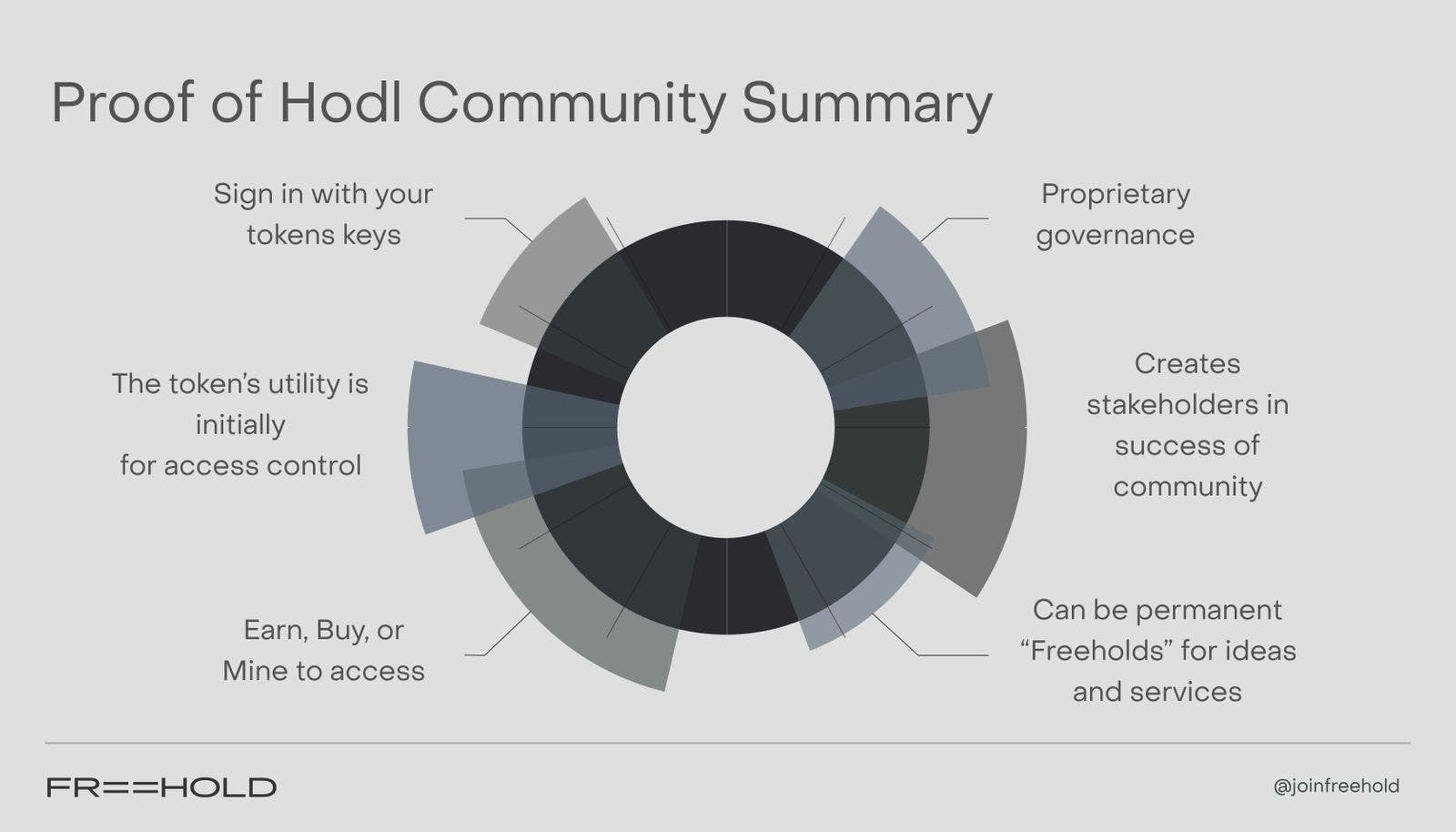

In summary, the proof of hodl community signs in with their token key, no transaction needed. Tokens initial utility is for access control. You can earn, buy, or mine your way to access. I think a lot of folks will choose to do proprietary governance where you have a benevolent dictator and if you don't like it you move out very easily, just liquidate. They'll be some decentralized governance I'm sure but I have a feeling proprietary will win the day. Even if it's done via pseudonyms, creates stakeholders in the success of the community and thus bolstering this concept of community builder as founder which we're going to see as a big theme of the 2020s. And then lastly, there can be permanent freeholds for ideas and services that live on forever. and ideally all these are anchored in Bitcoin. These will be places that our grandchildren can live in occupy and have a stake in.

Thank you very much.

Subscribe to the newsletter

Get emails from me about interesting things I find on the Internet.

No spam, ever.